CurbedLA recently caught hold of a shocking listing in Malibu – the three-story, unimaginably vulgar, hot-pink decorated condo belonging to beloved Los Angeles icon Angelyne.

If you’ve never heard of her, she’s basically the patron saint of the “famous for nothing” (think Paris Hilton, Camille Grammer, etc). She rose to “fame” in the 80s and 90s, when billboards and murals began popping up and showcasing her, um, “charms”.

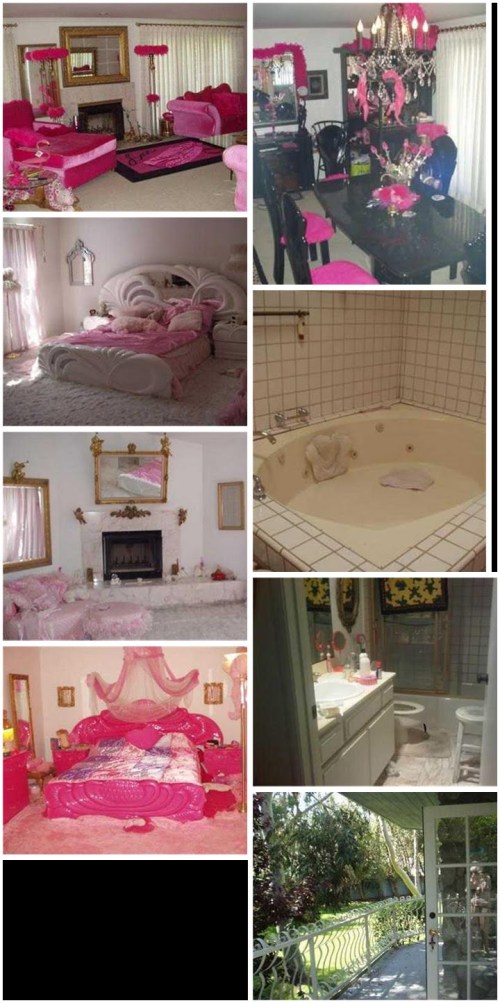

Kudos to Angelyne for making a name for herself (probably not her real name, though). It’s really too bad, though, that when she made her deal with the Devil she let the Devil keep the decorating skills. Take a peek:

It’s upsetting, no?

There is, however, a silver lining (NOT a hot pink lining):

1. This place actually sold for $25K above its listing price. (Um, what? Yeah.)

2. The RealEstalker article about this place when it first went on the market back in November ’10 is ab.so.lute.ly. fab.ul.ous. We always enjoy catching up with the RealEstalker, but this article is particularly enjoyable. Behold, an excerpt:

Listing photos show that at least one of the three guest bedrooms was worked over and put through the wringer of Angelyne’s one-noted and all pink decorative sensibility and includes cotton candy colored walls, matching deep shag carpeting, and a molded plastic bed frame, end tables and dresser set in the shiniest of hot pink a person should never see. Where does a person even buy furniture like that? Seriously, folks, where? Really turning the decorative piss into vinegar is that tawdry, gauzy and two-toned wannabe baldachin that is only made more heart wrenching when seen in conjunction with the pink heart-shaped pillow and pile of discarded clothes on the floor around the bed.

If horrific decorating provides the impetus behind unparalleled pseudo-celeb real estate prose like that, we have to say that we’re fans.